A global trend that is gaining traction amid rise in digitization is the use of super applications. People desire an app that can perform a wide range of tasks. To make it sound familiar in a twist, they want super moms.

Super Apps aspirants gained angel investors and venture capitalist’s attention back in 2015. The sector has witnessed significant startup funding in India. Let’s delve deeper into this topic to grasp better the current excitement or debate surrounding super applications success.

What is a Super App?

In recent months, there has been a lot of talk about super-apps which can potentially replace niche-specific apps. Fintech, social apps, grocery, and ride-hailing apps are all vying to be an all-in-one platform.

Super apps are single mobile apps that provide multiple services under a single virtual umbrella. Users can now access a plethora of seemingly unrelated services in a single location on their mobile phones, rather than having to rely on different apps for different services.

The goal is to make it as simple as possible for users to use a single login for all of their needs. These platforms are envisioned as virtual malls worldwide, and different geographies have different reactions to the trend. The concept of super applications has been around for a while.

Western players have been experimenting with excellent applications for several years, whether in grocery, fun games, or other fields. Since conception, these players were able to raise huge amount of angel investment, venture capital fund and private equity funding and even continue to do so.

Still, they have failed to gain traction or widespread appeal. When significant companies enter this space, such as Meta, it will be interesting to see how customers in the UK, US, and Europe react.

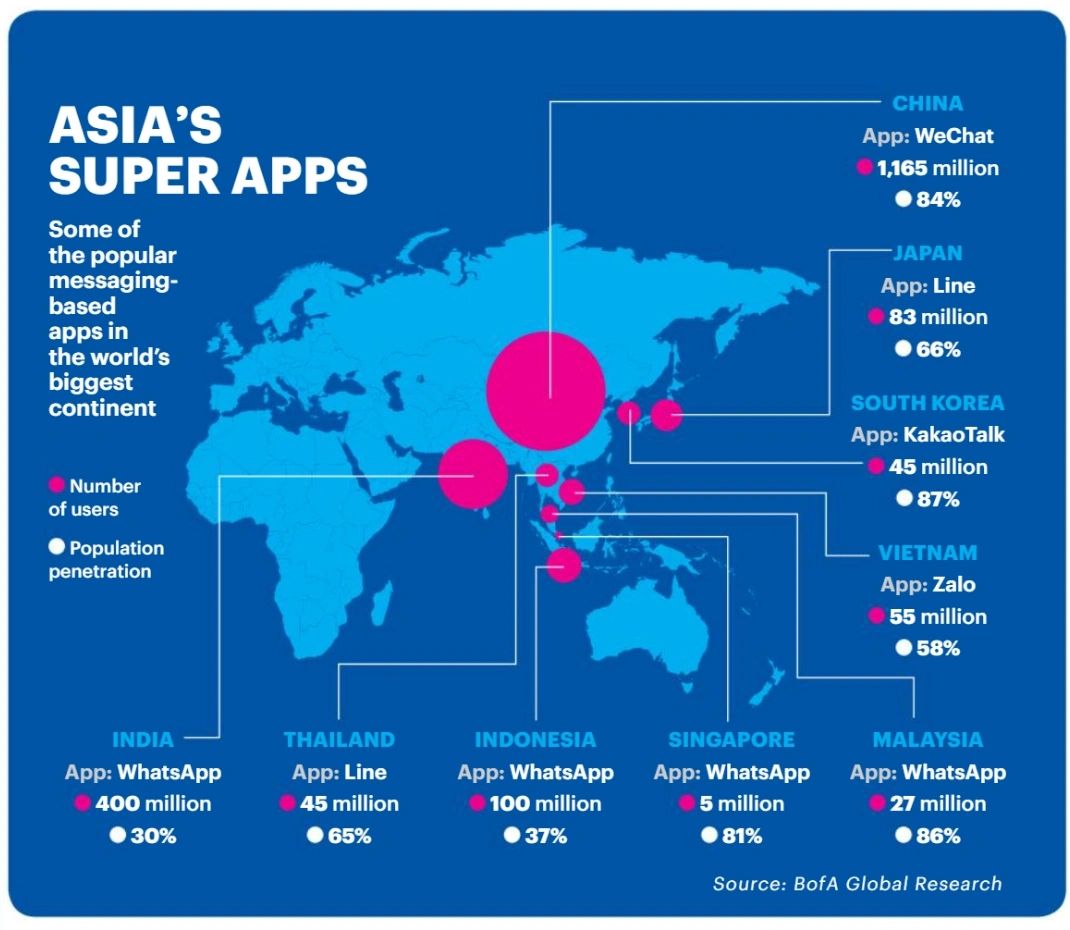

Though, China has had a unique experience. The world’s most populous country has scaled mega applications with Alibaba and Tencent due to their rapid development in internet access. Unlike west, super-apps in China like WeChat, and AliPay had been profitable and hence, gave good confidence to their early angel investors and VC Funds which invested in them.

However, there has been little discernible growth in the super applications industry in Asia as a whole.

Super Apps Rise in India

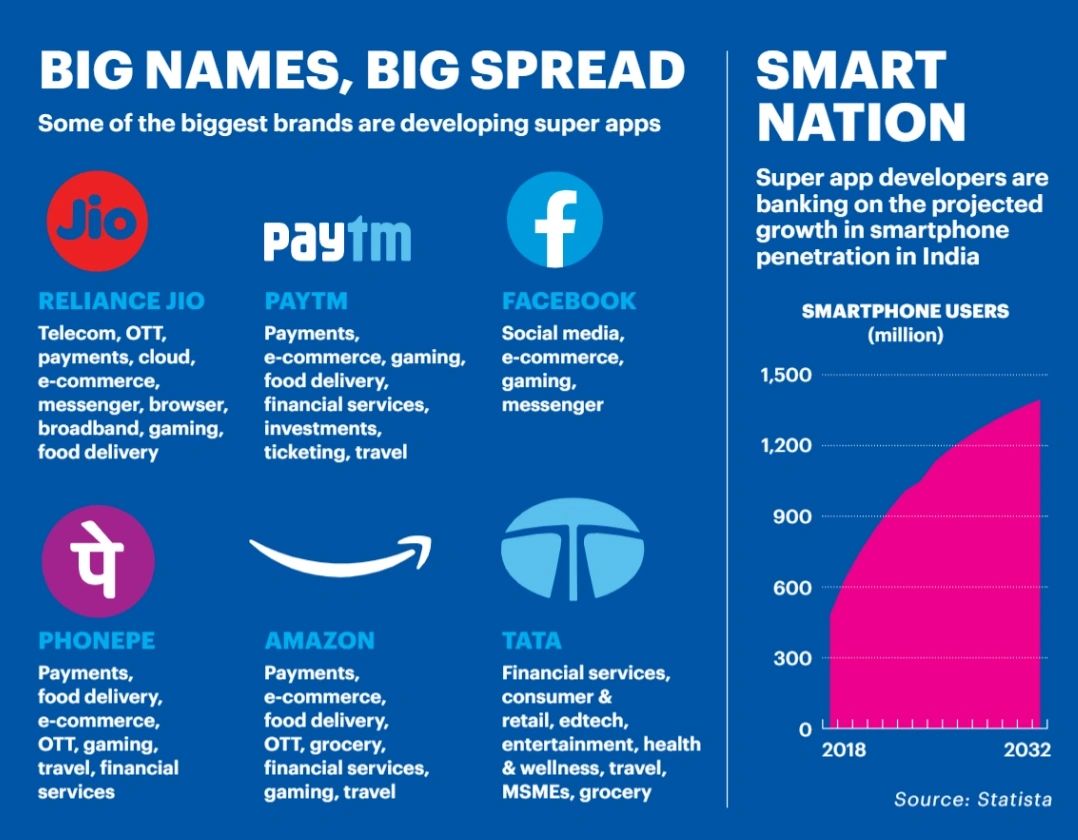

In India, super apps are still in a nascent stage. In many ways, the super app has become the Holy Grail that every company—from conglomerates like Tata and Reliance to FinTech players like Paytm to even Big Tech firms such as Facebook and Amazon is in the fray to own.

Are Super Apps successful?

While India is still a newcomer to the industry, super apps might will face a lot of challenges to become the much-heralded revolutionary disruptors in the mobile B2C space. There are a variety of reasons for the same:

1. To begin with, the super apps scenario in India appears depressing because the sector already has established leaders in various product categories such as Financial Services, groceries, garments, and so on. These niche players are also backed by eminent angel investors and venture capitalists and continue to raise more rounds of startup funding. Because of the significant financial and human resources invested, incumbent champions in their respective classes are challenging to dethrone.

2. Furthermore, as previously stated, the global trajectory of super apps, except China, has not been particularly encouraging. To date, no single company has developed a fully functional, all-encompassing super app model. Salesforce and ServiceNow, for example, have been developing ecosystems that began with primary offerings and gradually expanded to include solutions and services from prominent partners in their suite of apps.

3. The Chinese players who have gained traction have a wealth of contextual history to their credit, beginning with their journey of digital penetration throughout China. Tencent, the Chinese internet juggernaut and super app leader, accomplished this with its WeChat app, which served as a virtual platform for easing life in China online. WeChat was the first to offer the concept of a super app effectively. It quickly grew into more than just a social networking platform, offering a plethora of services to over a billion members, including payment services, games, doctor consultations, financing and loan services, hotel reservations, and auto transactions.

4. Super apps are also likely to face challenges because they do not provide enough value production potential for partners. The foundation of any digital ecosystem provides lucrative growth for all parties involved. Most super app models have thus far resulted in monopolies or, at best, duopolies, casting doubt on their long-term viability

5. Additionally, developing customer-centric offers is critical for a thriving digital ecosystem, which necessitates a high level of user engagement and stickiness, and achieving to create meaningful consumer value propositions will require a significant amount of equity funding.

6. India, being a highly regulated country, particularly in the areas of FinTech, lending, and peer-to-peer or marketplace models, compliance operations will also be a headache for them with limited capital amid cash burn and scaling up.

User Experience of Super Apps

Super app aspirants will find it hard to be the kings of multiple markets while providing the best user experience in all fields they are operating in. There are specialized applications for travel, shopping, and payments. Corporations strive to provide their users with the best possible experience, which will be challenging for super apps.

Another thing super app players are not taking into account is that variety is the spice of life. Shopping is an experience users cherish. There are recreational elements to shopping or engaging services that people like to experience. Take for example, LensKart and Nykaa’s amazing and gamified UX has made them outperform other generic competitors and marketplaces.

Super apps can seem binding and monochromatic to a user. While discounting the convenience of use, they take away the charm of visiting different online retailers or brands to get a sense of the variety and multitude of choices available.

Conclusion

To disrupt the Indian market, Super apps must provide a smooth marketplace user experience with significant customer appeal to compete with Indian users’ favorite standalone apps.

With the internet ecosystem becoming increasingly crowded and a plethora of apps vying for users’ attention, a super app must be able to cut through the noise and establish itself as a necessity rather than a luxury to be integrated into people’s lives and not only capture but also retain their attention. By any measure, this is a difficult task.

With the ecosystem becoming increasingly congested, a super app must break through the noise and demonstrate that it is a necessity rather than a luxury to be integrated into people’s lives. It will be interesting to see in this decade, how these super-apps perform, and whether they are able to stand on the expectations of angel investors and venture capital funds.