WealthTech emerged as a result of the confluence of digitization and the investing and wealth management industries. Companies and people’ assets and savings are now managed in a very different way than they were just a decade ago.

Because of the democratisation and expansion of certain types of services and aspects brought about by the internet boom, tasks and processes previously reserved for experts in wealth management, investments, and savings now are directly in the hands of users and businesses, thanks to a set of intuitive digital tools made available on the internet with the help of innovative startups backed by Startup Fundings.

From its present size of $20 billion, the Indian WealthTech market is expected to rise to above $60 billion by financial year 2025. And as per CB Insights, WealthTech had a financing surge in 2021, with $5.6 billion raised, which is higher than the $5.2 billion raised at the end of 2020. What is WealthTech, what is the history of this development, and what can we anticipate from this industry? These are all the questions that will be addressed in this blog.

What exactly is WealthTech?

Giving specific definitions to the ideas under consideration is a useful method to begin learning about the WealthTech industry.

WealthTech evolved under the so-called “X-Tech” concepts, combining the terms “Wealth” (savings, investments, or patrimony) and “Tech” (Technology) to bring together a series of companies, projects, and digital solutions focused on the administration of assets and savings under one umbrella. It is an investment advisory service that financial advisers give to their wealthy customers to help them solve or improve their financial position. Tax planning, wealth protection, estate planning, family governance and succession planning as well as wealth structuring and planning, are examples of such services. Advisors’ primary purpose is to help their customers build, preserve, and safeguard their money.

Although certain investment management activities have been digitalized for some time, we define WealthTech as the introduction of wholly creative and disruptive services and technologies that are put in the hands of the end-user and not so much of intermediaries. Similarly, we use the word WealthTech to refer to the use of next-generation technologies like artificial intelligence, machine learning, and sophisticated big data analytics in investment management. Through the digital platforms and solutions developed by technology businesses focused on this field, both end-users, Venture and Angel investment management professionals and specialists may access these cutting-edge approaches.

THE WEALTHTECH ECOSYSTEM

We can see how the WealthTech sector is made up in this way, separating initiatives and companies with a B2B emphasis on technologically advanced services for professionals and companies specialising in investments, wealth, and savings management from those aimed at the B2C end-user suited to the needs of the standard user.

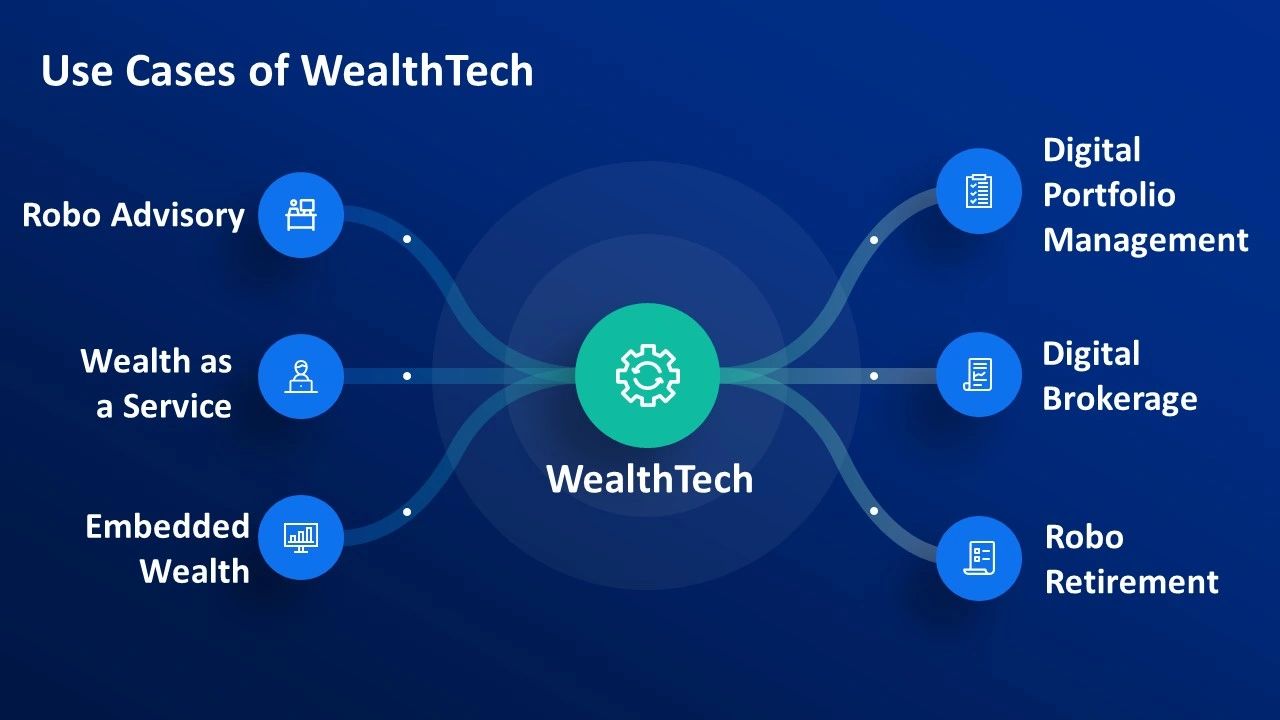

As a result, previously unimaginable services have evolved, reinventing investing methods and changing the game rules in the financial sector, forming a WealthTech ecosystem structured by several categories of activities and services:

Marketplaces: Platforms that aggregate investment information in such a way that it facilitates operations in both investment funds and assets of all types.

Investment tools: Businesses in this area have developed a collection of digital tools that may be used to track portfolios, establish goal-setting notifications, and manage investment planning, among other things.

Compliance: The WealthTech and RegTech areas are in charge of guaranteeing compliance requirements within the sector’s activities.

Financial advisors: These businesses specialise in providing advice on Angel Investment and other investments through the internet. They provide advice to their clients by assisting them in making decisions, but they do not carry out the procedures themselves.

Robo advisors: These digital technologies undertake automatic tasks on the user’s or client’s behalf. They are passive asset management organisations that invest in a variety of instruments according to the user’s preferences.

Quant advisors: These systems, which emerged after Robo advisors, employ machine learning and artificial intelligence learning to effectively manage investment strategies.

Trading platforms: they are designed for a wide range of users, from experts to “amateurs,” and serve as a digital platform for real-time trading with a variety of features.

Algorithmic trading: Software that automates real-time trading operations has been developed based on the execution foundation found in trading platforms.

Social trading/investing: They began as a social extension of trading systems, allowing traders to share their opinions and experiences with others while also replicating their investment strategies. They may be viewed as a means of combining and bringing the realities of social networks into the realm of trading and investing.

Micro investing: This field is specialised in encouraging savings and investment through micro-credits or tiny investments, and is closely tied to Fintech efforts such as lending or crowdfunding and Equity Funding.

B2B software providers: A wide group of startups and technology firms that specialise in delivering various digital solutions to experts in the investment, savings, wealth, and trading sectors. At the same time as providing technical and technological help to investment businesses, they produce revolutionary software and apps for use in the field.

Big data analytics: Analytics companies that specialise in delivering investment data analytics solutions, usually with a B2B profile.

WealthTech has completely changed the way we view modern finance and the running of the economy, democratizing formerly exclusive activities and boosting expertise and effectiveness in financial processes. These are only a few of the different categories and technologies which are at the forefront of this new category. Whereas the solutions and services have been established and tailored for Indian acceptance, in theory, the prospects are just now becoming apparent.

In contrast to industrialized economies such as the United States, where over half of the families have investments, just around 2% of Indians actively invest. While a lack of knowledge has historically been a barrier to this industry’s growth, there are currently a number of growth factors and behavioral shifts that are primed to propel this segment’s predicted market growth to 3X:

High Awareness and Financial Literacy: Due to India’s young demographic and growing education levels, along with the abundance and availability of high-quality financial data, there has been a spike in the number of youth Angel Investors buying financial goods and solutions, a category traditionally considered as ‘daunting’ and ‘aspirational’ due to the previous (and wrong) perception of this sector as being ‘risky’ and ‘capital-intensive.’ As a result of their increased financial literacy, new investors are better able to comprehend the risks, concepts, and solutions connected with various budgets and goals.

Higher Disposable Income: For decades, the narrative of India’s growing riches has been extensively recorded. Indians are today ‘better off’ than they were twenty years ago due to increased urbanization, skilling, education, and opportunity. From FY15 to FY19, India has one of the greatest growth rates of expendable cash in the world, with a rate of over 30% Furthermore, India’s Tier-2 markets and areas have had even faster growth rates in income, education, and technology penetration, creating a lucrative and underserved target market for these solutions. More Indians have been able to access the market and participate in products and solutions across multiple time and Venture Capital horizons as their wealth have grown in tandem with their financial knowledge and awareness.

Better and More Efficient Technologies: Motivation without a plan leads to inactivity. The sophisticated, smooth, and high-end technology solutions and products supplied by many domestic and foreign firms have been crucial drivers in the development of WealthTech solutions. These platforms have concentrated and invested not only in the underlying technology of complex algorithms and real-time big data analysis but also in the user interface (UI) and customer experience design (UX) elements. This is (and will continue to be) an important component in the mass adoption and engagement of newer users. It’s no wonder, therefore, that one of India’s major WealthTech firms, Zerodha Broking Ltd., is not only among the top 20 websites frequented by Indians on a daily basis but also has the most ‘daily time on site’ of all India’s top 50 websites, at more than 25 minutes.

These considerations have touched on a few of the factors that contribute to the Indian WealthTech potential. Because of the money the segment has received in recent years, the infrastructure and ecosystem also saw significant expansion. In 2021 and 2022, WealthTech saw over $100 million in investments from international and local angel investors across a variety of projects. With greater innovation, higher average ticket sizes, a much more efficient network effect and spillover, and innovative use-cases and solutions, the industry – which presently has roughly 4 million WealthTech investors – has the potential to attract many times the existing investment levels.