The Indian startup ecosystem proved to be a watershed moment in 2021, with approximately $36 billion in startup funding: the frenzied fundraising, IPO euphoria, and historic exits smashing all previous records.

In recent years, there has been an increase in startup funding in India. In fact, VC funding in India has more than tripled in the previous few years. This has resulted in a surge in unicorns, or firms worth more than $1 billion. With the Indian economy growing rapidly, investors are beginning to see potential in the Indian startup ecosystem.

2021 also proved to be a full-cycle year for angel investors, venture capitalist, and private equity funding companies in India. Companies like Zomato, Nykaa, and PolicyBazaar delivered outsized exits to their investors by listing on public bourses. This was also the year of the startup unicorns for India, as 42 startups achieved billion-dollar valuations, doubling its count of the past decade.

A Shift in Trends of Equity Funding:

In a report by industry body Indian Private Equity and Venture Capital Association (IVCA) and consulting firm EY, it was said that the average ticket size of early-stage deals grew to $4.1 million in 2021 compared to $2.8 million in the January-July period that year. Several leading angel investment networks and VC funding companies are now actively looking at early-stage startups.

With exits at an all-time high, there is so much secondary money going around as well. It’s been observed that young founders prefer going with a larger fund that can write subsequent cheques or with serial entrepreneurs who have been there and done it a couple of times.

Average late-stage fund round sizes are also growing. In fact, in the January-July period of 2021, it was higher than the average cheque sizes of the past two years combined. Late-stage cheques sizes grew from $88.7 million in 2020 and $90.9 million in 2019 to $217.6 million in 2021 January-July, led by private equity funding companies.

Across industries, it’s a broader macroeconomic phenomenon where most new enterprise creations outside of physical infra-heavy businesses will be tech startups. That would also mean a rush of unicorns.

Unicorns are on a Fast Track:

Tech-led startups are rewriting the pace of business aggregation across sectors. While e-commerce, fintech, SaaS, and ed-tech were prolific sectors that have created unicorns, we have the beginnings of unicorns in every sector now – healthcare, B2B commerce, and the first deep-tech ones are coming.

Electric vehicles and the ecosystems that support them can alone create a few dozen of these unicorns. The EV market is expected to grow at an estimated CAGR of 90% from 2021 to 2030 and be worth more than $150 billion by 2030; hence significant angel investment and venture capital inflows are being observed in this segment.

With more innovation, backing by the government, and the easy availability of startup funding in India, unicorn numbers will continue to grow significantly. Meanwhile, the growth is also attracting legacy businesses to the digital front. To accelerate its super app play, Tata made three big-ticket acquisitions last year—BigBasket, 1mg and CureFit. At the same time, Reliance has invested in quick commerce firm Dunzo, lingerie retailer Zivame, subscription-based hyperlocal grocery delivery platform Milkbasket, furniture retailer UrbanLadder, and e-pharmacy Netmeds.

Legacy companies are, thus, disrupting the digital space by investing in and expanding some of the key vertical categories while also offering attractive exit opportunities to early-stage investors.

What was once thought of as an ambitious target of 100 unicorns by 2025 will be breached in the next few months. The startup ecosystem should rerate ambition to 500 by 2030 and aspire to hit it by 2027-28. Fintech and SaaS may create the most significant numbers, along with e-commerce.

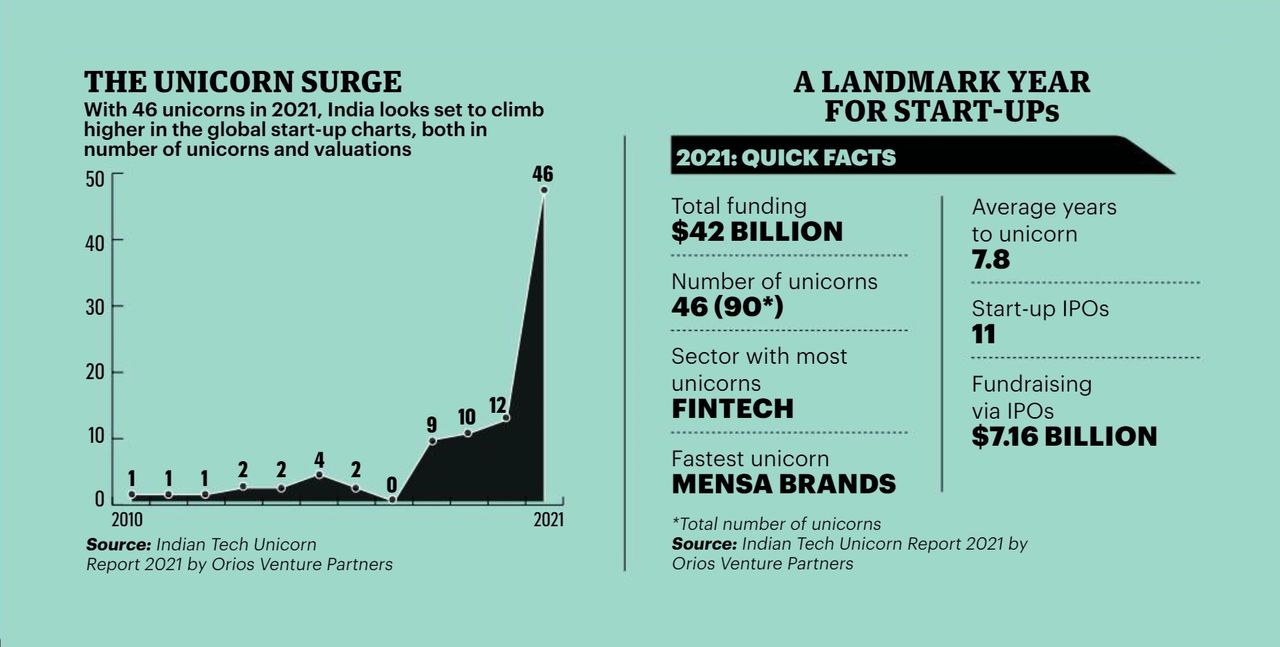

According to a recent report, 46 out of India’s 90 unicorns were created in 2021. The first 44 were born through a decade or more. Together, technology startups raised $42 billion in 2021, up from $11.5 billion in 2020. Along with this, a total of 11 startups, including eight unicorns, raised around $7.16 billion through public offerings.

IPOs of Young-Tech Startups:

The floodgates have opened for India’s beginnings of a large-cap tech universe. For young tech startups, it is going to be a tough road. Post-IPO, founders who have dealt with 10-20 investors so far on their cap table will need to deal with quarterly and annual goals, information disclosures, high governance, and consistent business (growth) performance or cycles.

The IPO stories of 2021 notwithstanding, accessing public markets will not be an easy task relative to a private equity funding. It is also not about simply hiring an investment banker and lawyers to help you with pre-IPO filings and the listing. It is the beginning of a multi-year journey that will demand a lot of introspection, a massive upgrade of governance processes and behaviour, more scrutiny on one’s public personas, and a culture change in young, hot tech startups.

That said, it will be advantageous for long-term company builders. Companies that built despite the odds for a decade and are just starting to build for another decade are relishing the idea of listing. They should aim to continue growing at 30-50 per cent Y-o-Y and being a darling of the stock market for another decade.

Repeat Founders and Seasoned Startup Professionals:

The talent pool of bold technology leaders has multiplied 100x since the beginning of the decade. Trained under unicorns, with rapid growth and incredible resilience, these new founders are like well-trained athletes ready for startup marathons.

Repeat founders who have had smaller exits and then built under a more prominent firm or seasoned executives who were a part of a unicorn build-out tend to understand market issues better. They are more fluent in startup funding and are deliberate about choosing co-founders and building initial teams for their new startup journey. With the kind of experience and differentiated insights they bring, angel investors are more than happy to invest in their ventures at pre-seed stages.

The year 2022 is expected to continue blockbuster VC funding rounds headlined by many repeat founders. The growth in number and quality of these seasoned founders over the past 3-4 years has been astounding, and venture capitalists continue to back them with mega large seed rounds at unheard-of valuations. As long as the exits keep coming, this trend will persist.

Conclusion:

Our path to $5,000 per capita GDP and beyond will be paved with digital-enabled roads and infrastructure. The government machinery has created an incredible amount of world-class infrastructure and rails to enable this.

The brightest tech minds are building world-class products and businesses on these rails. Today, India is the third-largest unicorn hub after the US (487) and China (301), and in 2021, one out of 13 unicorns globally was born in India. India as a growth story is expected to continue even if there is a slight short-term correction.

In a nutshell, the market is predicted to continue to grow, with many things going for it. The pace of venture capital flow is expected to continue, and there will be many more large rounds as companies continue to scale. This will, in turn, enable more and more Indian companies to expand beyond borders.