You are a participant in the contemporary web if you are reading this. The internet we use now is quite different from what it was only ten years ago. How has the internet changed throughout time, and more importantly, where is it headed next? What’s more, why does any of this matter?

For the most part, the phrase Web3 alludes to a shift in the internet’s architecture toward decentralized technologies like blockchain, and away from the giant tech companies that some believe have too much influence over it.

Web3 supporters claim that it will improve transparency and accessibility, as well as open up the internet to new creative technologies. Others, such as Twitter co-founder Jack Dorsey, claim that Web3 has already been centralized and is controlled by venture capital rather than big tech.

Regardless of the controversy, investors (Venture Capitalists/ Angel investors) seem to be interested by the concept, and are now focused on the infrastructure and assisting developers in building it out.

Because of Ethereum’s intrinsic decentralization, several Web3 developers have decided to create apps:

· Anyone on the network has authorization to use the service, thus it isn’t necessary to ask permission.

· No one can prevent you from using the service or refuse you access.

· The native token, ether, is used to make payments (ETH).

· Ethereum is turing-complete, which means you can program almost anything with it.

Women, men, robots, and corporations will be able to exchange value, information, and collaborate with worldwide counterparties they don’t know or expressly trust without the need of an intermediary thanks to Web 3.0. The most significant change permitted by Web3.0 is the reduction of the level of trust necessary for global coordination. This represents a shift toward instinctively trusting all network components rather than expressly trusting each member and/or striving to obtain trust extrinsically.

Scope of Web3

Web 3.0 will vastly expand the breadth and extent of human and machine interactions far beyond anything we can now imagine. These interactions will be possible with a far broader range of potential counterparties, including frictionless payments, richer information flows, and secure data transfers. Without having to pay a fee to a middleman, Web 3.0 will enable us to communicate with any person or machine on the earth. This shift will open up a whole new universe of previously unimagined enterprises and business structures, from global co-operatives to decentralized autonomous organizations and self-sovereign data marketplaces.

This is significant because:

Why Disintermediating industries, removing rent-seeking third parties, and distributing this value directly to consumers and suppliers through a network may help societies become more efficient.

· Through their new mesh of more adaptive peer-to-peer communication and governance linkages between members, organizations may be innately more robust to change.

· Humans, businesses, and robots can exchange more data while maintaining more privacy and security.

· We can practically eliminate the platform reliance concerns that we see now to future-proof entrepreneurial and investment activity.

· Why We can own our own data and digital footprints by using proven digital scarcity of data and tokenized digital assets.

· Through modern mutual’ ownership and management of these new decentralised intelligence systems, as well as sophisticated and dynamic economic incentives, network members may collaborate to overcome previously intractable or ‘thinly dispersed’ difficulties.

Venture Capitalists are pouring money into it.

Web 2 vs. Web 3: What’s the Difference?

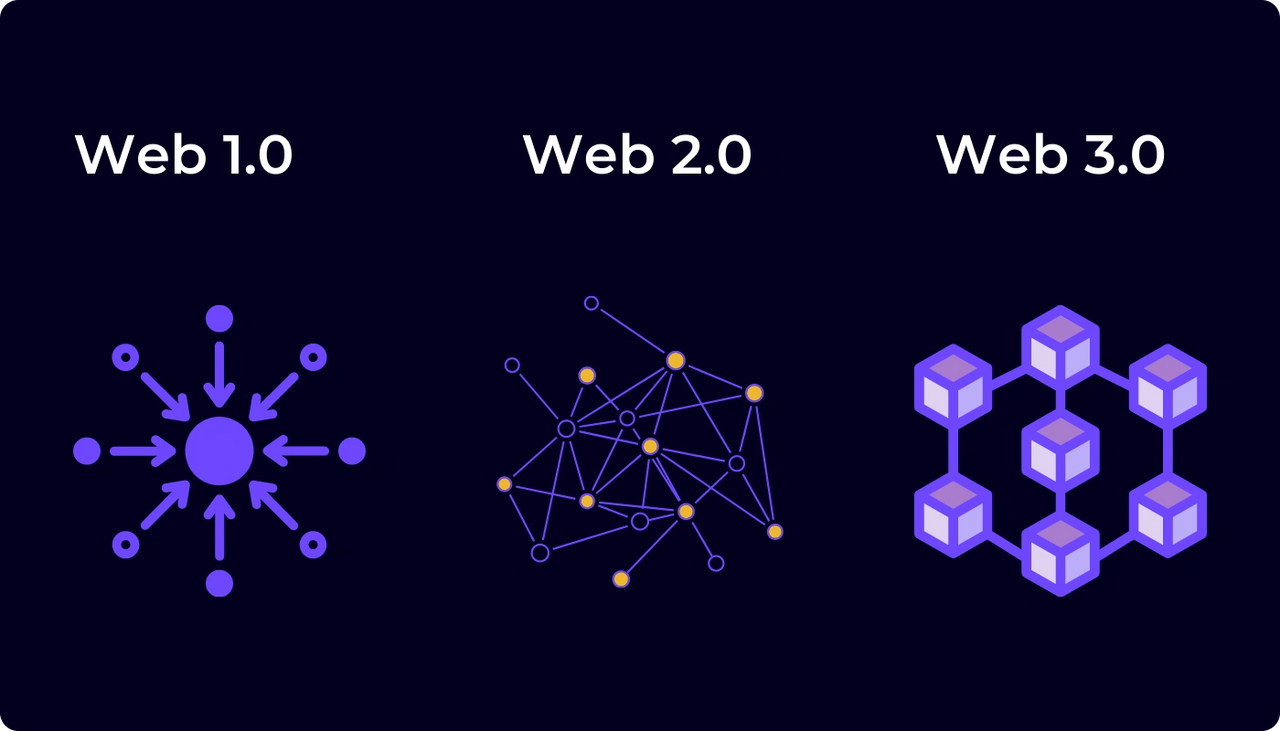

Web 2.0 and Web 3.0 are enhanced revisions of the original Web 1.0, which was popular in the 1990s and early 2000s. Online 2.0 is the current form of the web that we are all acquainted with, while Web 3.0 is the future phase of the web, which will be decentralized, open, and more useful.

· The exponential expansion of Web 2.0 has been fueled by innovations such as smartphones, mobile Internet access, and social networks.

· Web 2.0 has caused havoc in industries that have yet to adapt to the new web-based business model.

· Decentralization, trustless and permissionless computing, artificial intelligence (AI) and machine learning, and connectedness and ubiquity are all characteristics of Web 3.0.

Why are Venture Capitalists so bullish on Web3?

Investor interest in what some believe will be the next generation of the internet has developed as phrases like “Web3” and “decentralized web” have become popular in the startup world.

Two businesses that help developers create decentralized apps announced massive investment rounds earlier this month—in less than 24 hours.

Polygon Technology, an ethereum scaling platform located in India, raised a $450 million round headed by Sequoia Capital India on Feb. 7 for a projected $13 billion value.

The following day, Alchemy, a San Francisco-based provider of tools and hosting for customers interested in transacting on blockchain and Web3, raised a $200 million “Series C-1” headed by Lightspeed and Silver Lake, valuing the business at $10.2 billion. Alchemy’s current value was roughly treble what it was when it received a $250 million Series C round only four months ago.

Web 2.0 firms would not have received these sorts of transactions five years ago.”

Investors (Venture Capitalists/ Angel Investors) seem to be gravitating to the emerging—if still somewhat undefined—space, despite the hefty prices. According to Crunchbase data, $17.9 billion was invested in 1,312 blockchain-related firms last year. That figure surpassed the previous record of $4.4 billion in 1,223 agreements set in 2018, as well as the $2.1 billion in 790 deals set in 2020.

Venture Capitalists have spent more than $3.8 billion into businesses in the field in 196 transactions so far this year, breaking even with last year’s record pace.

Companies that define themselves as Web3 startups received $380 million in 93 agreements the previous year, up from only $20.5 million in 30 deals in 2020.

In 34 transactions so far this year, Venture Capitalists have invested over $173 million into firms in the field, indicating a growing awareness of the sometimes-ill-defined space.

Twitter is exploring methods to integrate Web3 apps into its services. For example, instead of sending a tweet from a Twitter account, a tweet may be sent from a crypto account after login into Web3. Web3 capabilities will be added to ordinary Twitter in the future, according to Esther Crawford, senior project manager.

Facebook’s metaverse bet is a significant Web3 wager. Sundar Pichai, the CEO of Alphabet, said Google is also interested in contributing to the Web3 sector and has set up a blockchain-focused team.

Marc Andreessen, a former Netscape co-founder and co-founder of Andreessen Horowitz, has been a big supporter of tokens, De-Fi initiatives, and other Web3 investments. Horowitz funded Solana Labs, a rival to Ethereum that raised USD 314 million in funding. Andreessen Horowitz and Coinbase Ventures invested USD 260 million in Coinswitch Kuber, a crypto-trading platform, last year.

.jpg/:/cr=t:0%25,l:0%25,w:100%25,h:100%25/rs=w:1280)

Fundraising and the creation of a token economy

According to entrepreneurs and Venture Capitalists, fundraising in the Web3 ecosystem represents a big cultural change from Web2.

Unlike stocks, cap tables, and control, which dominate the Web2 environment, coin table, token economy, community, and decentralisation are some of the essential criteria that both entrepreneurs and Venture Capitalists should be looking at. The ownership of a startup is detailed in a capitalisation table (cap table).

The fact that token investors are asset purchasers rather than cap table investors is an extra benefit for these firms. This provides freedom and independence to the creators, as well as liquidity to investors, since the tokens may be traded on the market at any moment.

Of course, both the founders and the token investors face additional risks as a result of this.

Tokens also introduce the concept of tokenization and the creation of a token economy.

Consider the present status of establishing a software firm. Someone has an idea, but in order to begin construction, they need money to maintain themselves.

To get funds, they hire venture capitalists and give up a portion of the firm. This investment instantly establishes misaligned incentives that will, in the long term, prevent the greatest user experience from being built.

Also, even if the firm succeeds, it will take a long time for everyone engaged to enjoy any of the value, which might result in years of labour with little actual return on investment.

Instead, imagine announcing a fresh and innovative idea that answers a genuine need. From the beginning, anybody may help construct it or invest in it, not Venture Capitalists in this case. The corporation announces the release of a certain number of tokens, of which 10% will be given to early builders, 10% will be sold to the general public, and the remainder will be used to compensate contributors and support the project in the future.

Stakeholders may vote with their tokens on changes to the project’s future, and those who helped construct it can sell part of their holdings to profit when the tokens are distributed.

People who believe in the initiative may purchase and keep shares, while others who fear it is heading in the wrong path can sell their shares.

Purchasers have total transparency over what is occurring since blockchain data is entirely public and accessible. This is in contrast to purchasing stock in a private or centralized company, where many details are generally kept hidden.

This is already taking place in the web3 world.

The majority of Web3 businesses obtain funding via token sales rather than stock.

NFT Labs, which will debut its NFT marketplace “Itsmyne” later this month, produced a token called MYNE and sold 20% of the entire supply to a select group of Venture Capitalists at a reduced price, generating $2 million at a value of $12 million.

Radicle (a decentralized GitHub alternative) is one example of an app that enables stakeholders to engage in project governance. Another is Gitcoin, which enables developers to be compensated in bitcoin for participating in and contributing to Open-Source projects. Yearn enables stakeholders to take part in decision-making and proposal voting. Tokens have been issued by Uniswap, SuperRare, The Graph, Audius, and a slew of other protocols and initiatives to allow ownership, participation, and governance.

Despite some skepticism about Web3’s long-term viability, VCs are pouring money into it.